Table of Contents

An Additional Pair of Hands Needed

Local Independent Contractor Pitfall

Remote and Async Strategies

Final Remarks

Contributors

Tiny Manyonga

Contributor

Launching a business takes time and effort. Sole proprietors often wear many hats. They are often the CEO, head of marketing, project manager, financial officer, accountant, and sometimes the only employee of their business. To have a chance to succeed, a business owner must manage and monitor several aspects of their business. If you have launched a business and you feel exhausted from what seems like just trying to keep your venture running, you are not alone.

A small business pulse survey found several issues faced by business owners. Some common themes from the survey are as follows:

- Overworked and underpaid – On average, business owners work 49 hours per week, with almost two-thirds working 50+ hours. Despite this, almost half feel they are working below their pay grade.

- Operations fatigue – Most business owners spend their time on day-to-day aspects of the business. Managing inventory and existing customers, responding to unscheduled communications, and performing administrative tasks take up most of the productive time. As much as 32% of time is spent on email and web browsing.

- Limited dedication to strategy – Business owners spend more time working in the business, not on it. Strategic decisions that focus on growing the business and its market, increasing profitability and productivity, and generating a lasting competitive advantage should ultimately be of higher priority, but get less time.

- Lack of self-development – Business owners would prefer to have time to improve their business management skills, for networking, idea generation, and identifying new opportunities. Instead, most time is spent putting out fires.

- Lack of work/life balance – Burnout is common among sole proprietors, and personal issues and other prolonged distractions can significantly disrupt the business. Most small business owners would prefer to have more time away from the business.

An Additional Pair of Hands Needed

Most business owners immediately recognize when they reach a point where they need help with their business. However, as a sole operator wearing many hats, it may be difficult to assess the profile of the individual needed by the business. Operations and logistics specialists are often not well-versed in bookkeeping and accounting. Marketing and social media specialists probably know little about inventory and supply chain management. Many sole proprietors often consider a personal assistant whom they can train to manage multiple aspects of the business. A viable solution, but not without risk.

Source: Bureau of Labor Statistics, *Lowest paid service work (Leisure & hospitality)

The above table was derived from the BLS. Hiring a minimum wage worker at approximately $15 per hour translates to almost $18 after tax and benefits. This is a $37,200 annual commitment. However, the most competent and educated individuals required to elevate your business are likely to aim for significantly more than that, about $66,000. Considering that many business owners regard themselves as under-compensated, this may be a significant burden to the business if the new employee does not add adequate value to operations.

Another significant consideration is the availability of capital. Among the top reasons why businesses fail, according to Forbes, are the lack of capital and ineffective marketing. In adverse economic conditions, like a recession, financial institutions tighten access to credit. But even in favorable times, accessing capital for a small business with limited assets and collateral can be a challenge. This is why it is vital to be prudent with cash reserves and to create a cost/benefit analysis before hiring a permanent employee. Regarding marketing, one may pour as much as they want into pay-per-click and other forms of advertising, but without a robust digital and social media presence and active marketing campaigns, the strategy will not gain new business. However, hiring a marketing firm or a permanent marketing specialist/social media manager might be an equally taxing commitment of cash reserves.

Local Independent Contractor Pitfall

In the face of significant commitments required to hire a permanent employee in the US, some business owners have resorted to misclassifying employees as independent contractors. There are some tangible monetary benefits when employers do this. Firstly, they need not worry about taxes and benefits. Furthermore, the protections offered to employees often do not extend to independent contractors. While this seems like a viable option, this comes with significant legal exposure that could ultimately lead to business failure.

There are key differences between independent contractors and employees that each business owner should consider. Typically, an independent contractor runs their own business, often works with multiple clients, and is in a temporary agreement with a business until a specific project is completed. An employee, on the other hand, is economically dependent on an employer who decides when they work, how much they are compensated, and which tasks to carry out (Department of Labor). Misclassifying an employee is a violation of the Fair Labor Standards Act, and consequences include, but are not limited to, criminal penalties, liability for back pay and unpaid taxes, and penalties relating to employer verification requirements (Form I-9).

Remote and Async Strategies

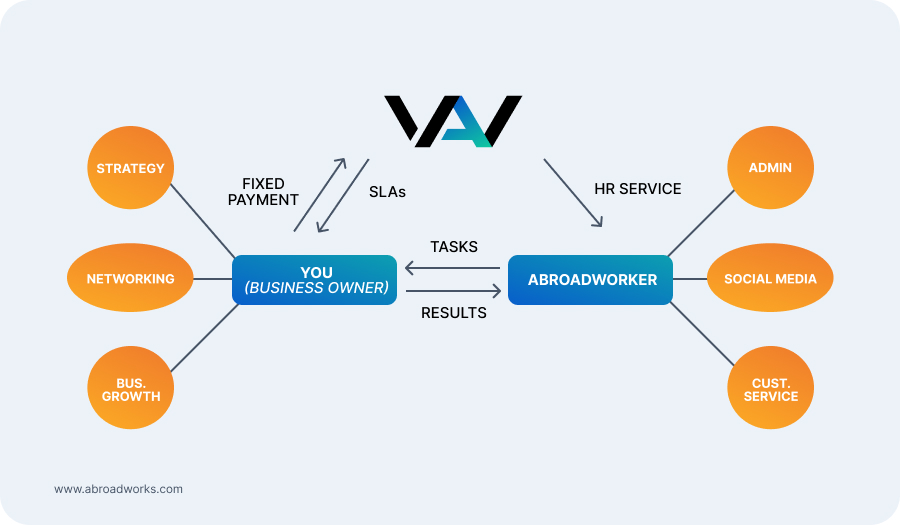

As a business owner, you could start your mornings with a clear inbox and no administrative tasks. Instead of wearing multiple hats and putting out fires, you can delegate repetitive and administrative tasks to a competent and dedicated professional. Remote technologies have enabled US business owners to contract professionals in accounting, customer service, sales, back-end and front-end IT roles, marketing professionals, as well as personal assistants who can be trained to handle multiple aspects of your business. It is even possible to organize collaborative remote teams on various platforms, but without the higher costs of hiring local professionals that come with additional tax and benefit expenses or the risk of employee misclassification.

Asynchronous collaboration is another added benefit. Because remote work can be done in different time zones, having an asynchronous collaborator can mitigate the impact of distractions and unscheduled communications. It is not uncommon that late-in-the-day emails require urgent attention. Some choose to stay at work just a bit longer to handle issues instead of interrupting the next day’s schedule. This is how business owners end up spending 50 hours per week on their business and lacking a healthy work/life balance. Async strategies can even be split between days. Having a competent collaborator who understands all aspects of your business could mean you can finally achieve the goal of a 4-day work week while your business continues to operate 7 days a week.

Final Remarks

Business owner burnout is not uncommon. Combined with the current economic uncertainty in the US, committing resources to a new employee may be an unnecessary risk to your financial stability. Acquiring highly qualified collaborators abroad has never been easier. Combining that with state-of-the-art assessment and performance management systems means business owners can focus on the broader vision of their venture, identify better opportunities, and improve their business management skills without a hefty financial commitment or exposure to legal liability.